21/03/2024

Interest rates - the case for doing absolutely nothing

Newsletter #68 - March 2024

The fundamentals

Economists have been discussing all types of economic forecasts over the last 12-24 months: are we going to have a recession, a hard landing, a soft landing or no landing at all, and where will inflation be heading given the observer’s preferred landing scenario?

If inflation does come down, central banks will, of course, lower interest rates.

As so often before, the forecasts of economists and the financial markets have been wrong, particularly with regard to the following factors.

Public spending

It is difficult not to have growth when public sectors are running huge deficits, as they have done since the onset of COVID-19. As we have pointed out in previous Newsletters, both the US and many EU countries have been running deficits of more than 5% of GDP per annum since 2021. There is still “money” to spend in the system, given the fiscal handouts and, especially in the US, there will be no tightening of fiscal policy in a presidential election year.

Employment and Unemployment

In the US, unemployment rates are close to 50-year lows at 3.9%; in Europe (EU), unemployment rates are close to 35-year lows. The labour market is therefore very tight, which is reflected in the increased compensation employees are getting.

Of course, the effect of low unemployment rates could be mitigated if there was a possibility of sourcing employees from a pool of people not participating in working life. Employment, however, remains close to all-time highs in both Europe and North America, and it has been difficult for many employers to retain employees when it is easy to get another, better-paid job down the street. As there is no possibility of increasing the work force significantly, this naturally puts pressure on unit labour costs.

Growth

In the US, economic growth has been quite good in recent quarters and nothing indicates that the economy is close to recession.

The EU economies, meanwhile, have seen more sluggish growth, and some countries, such as Germany, are hovering around zero growth year-on-year.

Impact on inflation

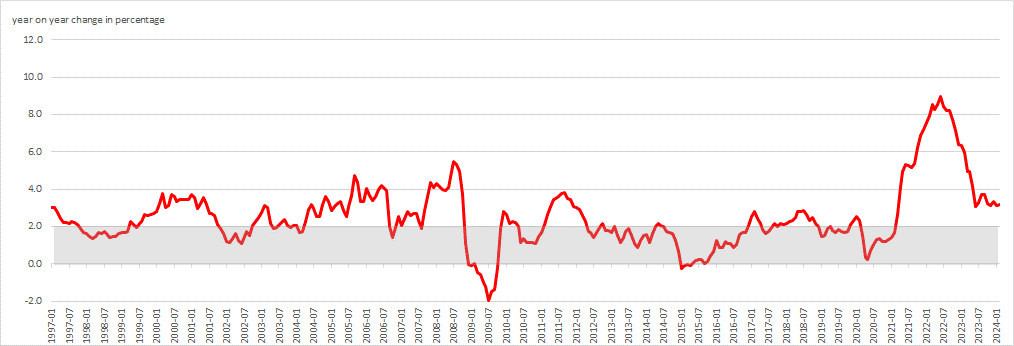

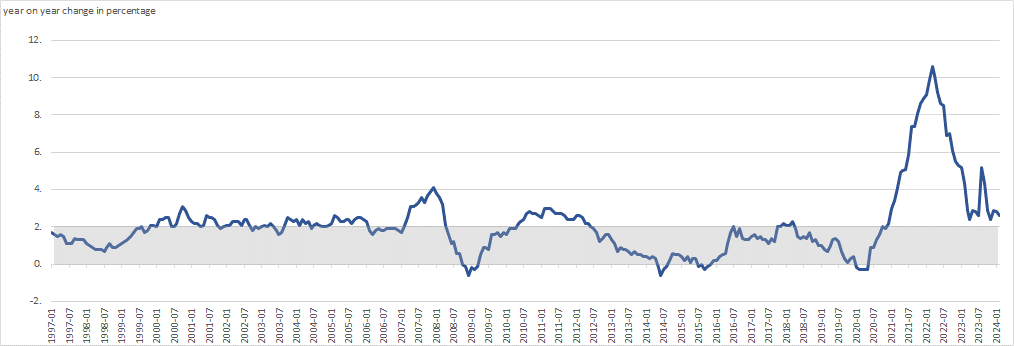

Inflation has fallen, but is still significantly above the target level for the central banks, as seen in the figures below.

Figure 1 US annual inflation with Federal Reserve target zone

Figure 2 Eurozone annual inflation with ECB target zone

Looking at the underlying components of inflation, part of the fall is due directly to lower energy prices, which have partly been manipulated by governments via subsidies.

However, core inflation, services inflation and goods inflation are all much higher than overall inflation and clearly above the central banks’ inflation targets.

The case for doing nothing

From a central bank point of view, then, there is a strong case for doing close to nothing on interest rates.

There is economic growth in the US; while EU growth is around zero overall, unemployment is low, employment is high and the public sector is pushing demand up while inflation is still clearly above target. Thus, it is difficult to argue that there are strong reasons to lower interest rates.

This is not a message that central bankers want to send to the public and it sounds a lot better to make moves in interest rates dependent of data. As if they have never been that before!