26/11/2024

Difficult and erratic times ahead - the United States and Germany at the helm

Newsletter #75 - November 2024

Trump secures re-election

The re-election of Donald Trump to the presidency of the United States has left many analysts, particularly in Europe, pondering the factors behind this outcome. While Kamala Harris and the Democratic Party were criticized for their inability to offer a persuasive alternative, the election's pivotal determinant appears to have been the economy, as voters prioritized financial concerns over other considerations.

Conventional economic indicators suggested an environment ripe for Democrat success. Unemployment remained at historic lows, inflation had receded, the Federal Reserve cut interest rates and the US stock market soared to unprecedented heights. These conditions should have favoured Harris. However, economic perceptions among the populace diverged starkly from the statistical narrative.

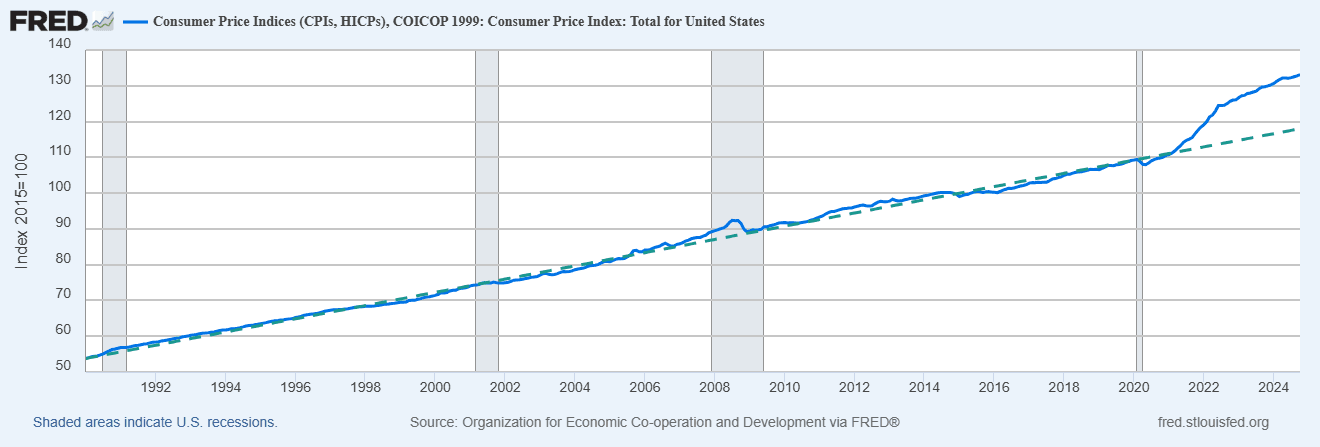

Figure 1 (below) captures the trajectory of the US Consumer Price Index (CPI) since 1990. Rather than presenting inflation data, the chart includes a trendline based on the CPI in the period from 1990 to 2020, extending the trend to 2024 and revealing a “gap” that many voters interpreted as a 10–15% erosion in their purchasing power. This perceived decline engendered a sense of economic disenfranchisement among average citizens, who consequently opted for change in the form of Trump’s presidency

Figure 1 US CPI index since 1990 (source FRED)

The Trump administration: tariffs, migration, and economic policy

As Trump begins assembling his administration, loyalty appears to be the primary criterion for appointments, with billionaire donors and steadfast allies positioned for key roles. This approach underscores Trump’s characteristic mercantilism, which prioritizes short-term national gains over broader economic principles.

From an economic perspective, tariffs function as a distortionary mechanism, impeding market efficiency and raising costs. Trump’s commitment to protectionism is expected to elevate inflation, as higher import costs filter through to consumers and domestic industries face diminished pressure to optimize productivity.

Adding to the complexity, Trump has signalled an intent to deport millions of undocumented immigrants, a move likely to exacerbate labour shortages in sectors heavily reliant on this workforce. Current estimates suggest that undocumented migrants constitute 25% of agricultural workers and 15% of employees in construction and service industries. A large-scale deportation initiative could disrupt these sectors to such an extent that even staples of American life, such as the availability of fast food, could be impacted.

Campaign promises: fiscal implications and risks.

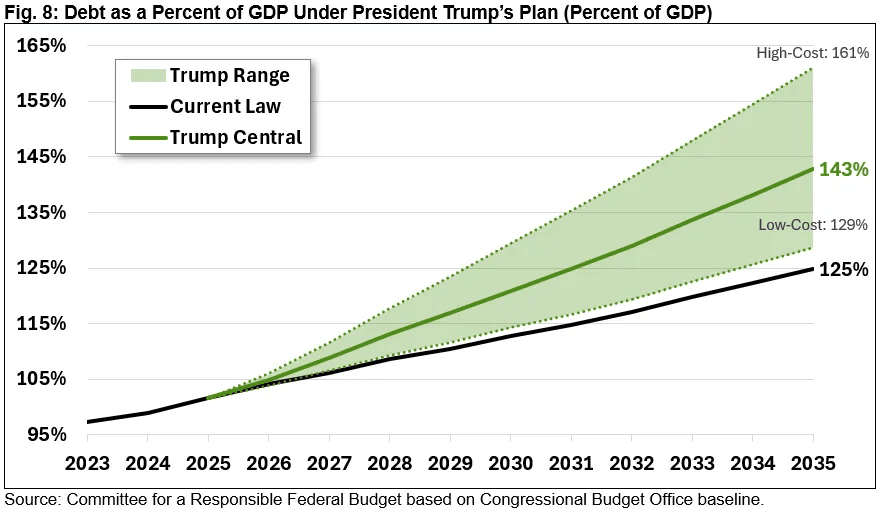

The non-partisan Committee for a Responsible Federal Budget (CRFB) assessed Trump’s campaign promises against the Congressional Budget Office’s baseline projections. The results, as depicted below in Figure 2, reveal significant fiscal risks. In the most optimistic scenario, the national debt-to-GDP ratio would rise to 129%, while the worst-case outcome predicts an alarming 161%. Even the central estimate of 143% signals fiscal strain

Figure 2 Estimated cost of Trump election promises

Tax cuts: revenue implications

Key proposals include extending the Tax Cuts and Jobs Act, exempting overtime income and tips from taxation, and abolishing taxes on Social Security benefits. These measures, while politically popular, could result in revenue losses of $6.1 trillion to $11 trillion between 2025 and 2035, depending on implementation specifics. The exemptions for overtime and tip income, in particular, invite opportunities for tax avoidance, further compounding revenue challenges.

Revenue generation: limited avenues

Trump’s revenue-generation strategies rely primarily on universal baseline tariffs, projected to yield $2 trillion to $4.3 trillion over the same period. However, if these tariffs fail to incentivize domestic production, they will merely shift the cost burden to consumers, thereby undermining their intended purpose. The only unequivocal fiscal benefit may arise from the reversal of Biden-era energy and environmental policies, including the elimination of subsidies and support programs.

Volatility looms for financial markets

While tax cuts typically buoy financial markets through higher corporate earnings and increased consumer spending, the Trump administration’s policies introduce significant uncertainties. The dual pressures of fiscal deficits and inflation are likely to create erratic market conditions. Furthermore, Trump’s unpredictable foreign policy, particularly regarding trade relations with China, could amplify volatility and exert downward pressure on the US dollar.

Germany: a political crossroads amid economic malaise

As if the uncertainties surrounding the Trump administration were not enough, European investors are now grappling with Germany’s precarious economic state and impending political upheaval. The nation, often seen as the stabilizing force within the European Union, is now contending with a sluggish economy and a fractured political landscape, setting the stage for protracted instability.

The collapse of the “traffic-light” coalition

The unravelling of Chancellor Olaf Scholz’s coalition government—a partnership between the Social Democrats (SPD), the Greens (Die Grünen), and the Free Democratic Party (FDP)—has plunged Germany into political disarray. The crisis was precipitated by Scholz’s dismissal of Finance Minister Christian Lindner, a key FDP figure, prompting the party’s withdrawal from the coalition. The fallout has led to a scheduled confidence vote on 16 December, which Scholz is widely expected to lose. This development will likely result in new elections on 23 February 2025.

Opinion polls indicate a power shift

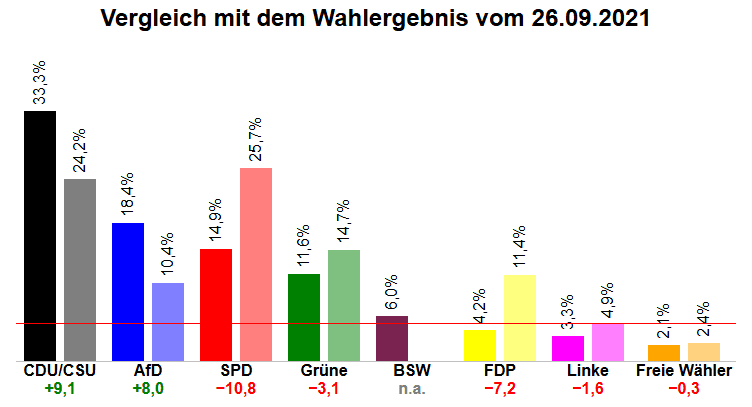

As reflected in Figure 3 (below), which compares current polling with the 2021 election results, the CDU/CSU bloc, led by Friedrich Merz, appears poised to emerge as the dominant force in the upcoming elections. The far-right Alternative für Deutschland (AfD) is also gaining ground, further complicating the political landscape. Meanwhile, the SPD is projected to experience a precipitous decline, with current polling suggesting a loss of more than 10 percentage points, relegating the party to third place. Scholz’s coalition partners are similarly poised for setbacks; Die Grünen may lose approximately 3 percentage points, while the FDP risks falling below the 5% vote threshold required for representation in the Bundestag unless it secures sufficient direct mandates.

Figure 3 DAWUM.DE - Weighted opinion polls Germany source DAVUM

Adding to the complexity is the rise of Bündnis Sahra Wagenknecht (BSW), a newly formed left-wing party, which is projected to surpass the 5% threshold. This development introduces another variable into an already fragmented political environment.

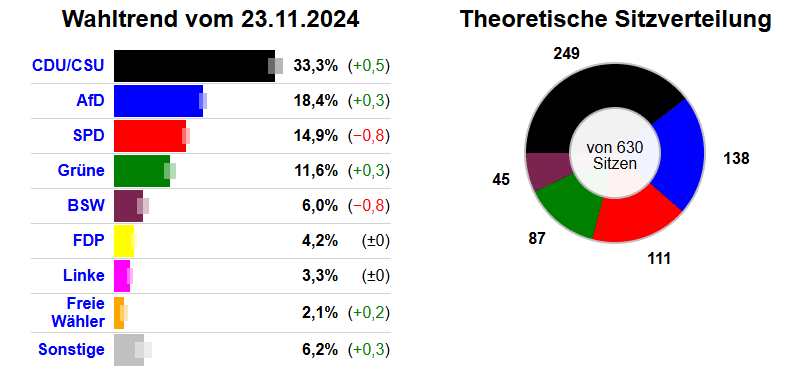

Figure 4 (below) shows the potential Bundestag factional structure based on the most recent polling data at the time of writing.

Challenges in forming a government

Should these polling trends materialize in February 2025, the process of forming a new government is expected to be arduous and time-consuming. While the CDU/CSU is likely to emerge as the largest party, Friedrich Merz has ruled out the possibility of a coalition with AfD, leaving partnerships with the SPD or Die Grünen as the most viable options. However, the SPD’s leadership crisis may further delay negotiations.

Within the SPD, there is mounting support for Boris Pistorius, the defence minister and one of Germany’s most popular politicians, to succeed Scholz. Pistorius’s pragmatism and pro-Ukraine stance make him a compelling candidate for centrist voters but could alienate the SPD’s left-wing faction, which shares ideological affinities with Sahra Wagenknecht’s new party. Pistorius himself has declined to pursue the role of Chancellor, perhaps strategically positioning himself to emerge as a unifying figure in the aftermath of the election.

A prolonged political vacuum

Germany’s political impasse is likely to persist well beyond the election. Should the SPD fail to exceed 15% of the vote, Scholz’s leadership will become untenable, necessitating a party realignment before serious coalition negotiations can commence. This delay will leave Germany, and by extension the European Union, in a state of political limbo at a time when decisive action is needed to address economic stagnation and broader geopolitical challenges.

Conclusion: navigating uncertain waters

As 2025 approaches, investors must brace for an environment marked by unpredictability. The Trump administration’s controversial policies, combined with Germany’s political impasse, create a volatile backdrop for global financial markets. With sentiment shifting unpredictably, market participants should prepare for heightened turbulence and rapidly evolving economic conditions.

References:

Committee for a Responsible Federal Budget:

https://www.crfb.org/papers/fiscal-impact-harris-and-trump-campaign-plans

DAWUM:

https://dawum.de/Bundestag/#Koalitionen